Easy Way to Do Direct Method Cash Flow Statement

FASB's Accounting Standards Update (ASU) 2016-14, Presentation of Financial Statements of Not-for-Profit Entities, removes the requirement that not-for-profit (NFP) entities that choose to prepare the statement of cash flows using the direct method must also present a reconciliation (the indirect method). This is one of the two impediments to the use of the direct method. The second is the informational needs; the indirect method can easily be prepared using a spreadsheet, which is usually not true for the direct method.

FASB has always considered the direct method of reporting cash flows preferable to the indirect method; in FASB's view, the direct method better achieves the cash flow statement's primary objective (to provide relevant information about the reporting entity's cash receipts and cash payments) and the overall objective of financial reporting (to provide information that is useful to users in making investment and credit decisions). FASB also asserts that a direct method statement is more useful to a broad range of users and enhances their ability to predict cash flows, and to assess the relationship between amounts reported on the income statement and the statement of cash flows.

Many financial statement users share FASB's preference for the direct method. A majority of financial analysts surveyed by the CFA Institute agreed that presenting operating cash flows using the direct method better enables them to forecast future cash flows of an entity than the indirect method (CFA Institute Member Poll: Cash Flow Survey, July 2009). FASB had considered requiring the direct method, but eventually decided neither to require it for NFP entities nor to require the presentation of both when the direct method is chosen.

Direct versus Indirect Methodologies

The direct method details where cash comes from and where it goes. In contrast, the indirect method starts with net income (for-profit entities) or the change in net assets (NFP entities), adds back non-cash expenses, removes gains and losses, and adjusts for the changes in current asset and current liability accounts. While the net cash provided or used by operating activities is the same with either method, the direct method directly provides the information users hope to ascertain from the statement. Furthermore, with a comparative balance sheet/statement of position and income statement/statement of activity, users can easily compute the same cash flows from operating activities using the indirect method, and thus the indirect method adds no information. Finally, the investing activity and financing activity sections are prepared using the direct method, so it makes intuitive sense that the operating activity section should be prepared on the same basis.

So why don't more companies use the direct method? First, the indirect method is required and the direct method is optional. Second, preparing the operating activity section using the direct method also requires disclosure of the cash flows from operating activities using the indirect method, effectively requiring double preparation and presentation of the operating activity section. Third, unlike the direct method, the indirect method can be prepared from virtually any standard chart of accounts. In contrast, the information required to use the direct method may not be readily available and may be tedious and difficult to develop. As if to highlight this, most accounting software only uses the indirect method to produce a statement of cash flows. Now that FASB has removed the requirement to show both methods when using the direct method, the only impediment is the informational requirement. Therefore, the time may be ripe for financial statement preparers to reevaluate their choice of method and reconsider the advantages and utility of the direct method.

Sample Direct Reporting

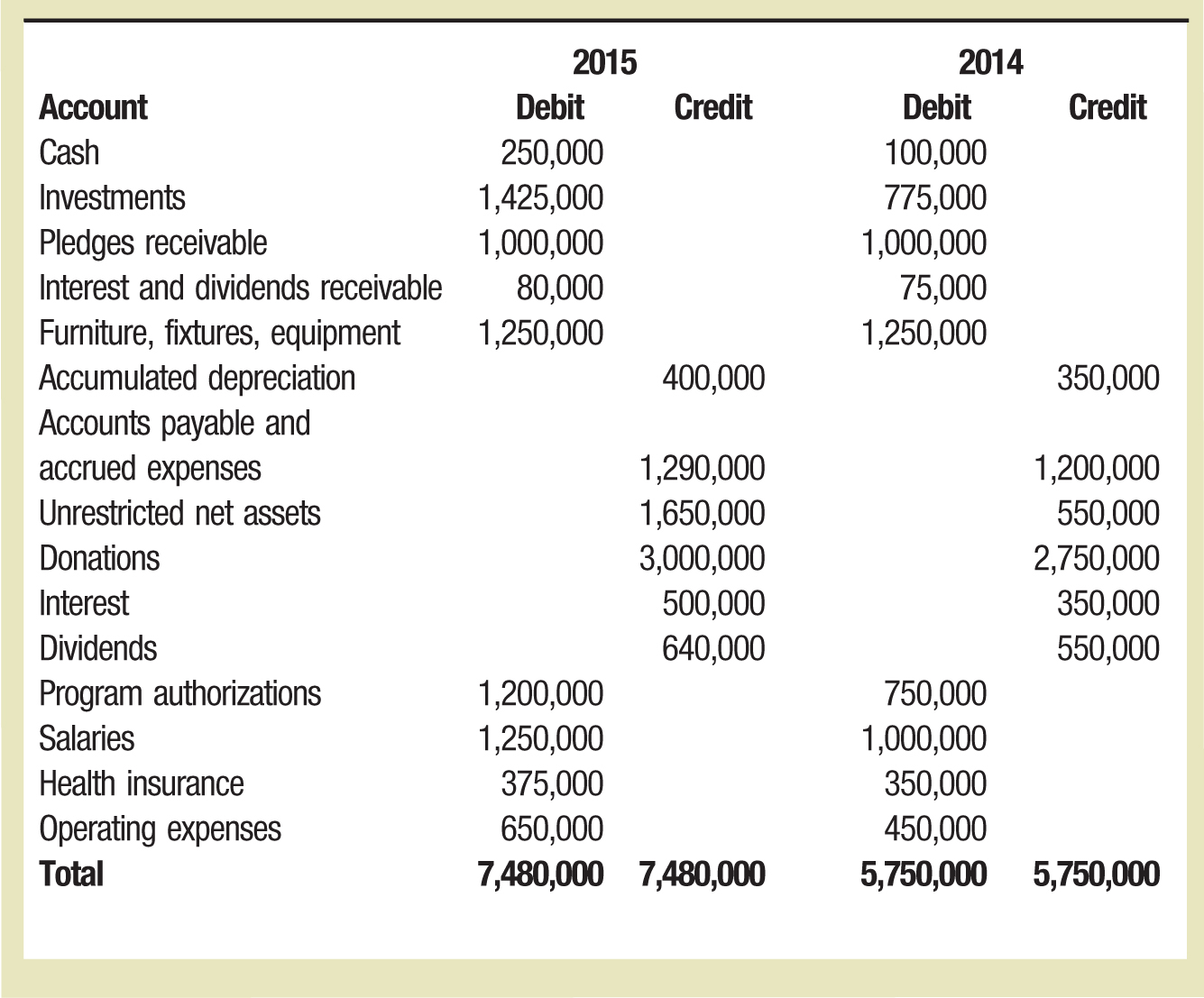

The first four Exhibits show the trial balance (Exhibit 1) used to develop the financial statements (statement of activities, Exhibit 2; statement of position, Exhibit 3; and statement of cash flows, Exhibit 4) for a hypothetical NFP entity using the indirect method. The NFP organization's governing board now desires a cash flow statement that better informs users where the cash came from and where it went. While simple statements using the direct method allow users to make some reasonable estimates, this is not so easy in an entity with more complex financial statements. There is, however, a way to make the preparation using the direct method as straightforward as the indirect method; it involves deciding which lines should be detailed in the operating activity section, then creating a discrete receivable or payable for each.

EXHIBIT 1

Sample Not-For-Profit Trial Balance For the Years Ended December 31, 2015, and 2014

EXHIBIT 2

Sample Not-For-Profit Statement of Activities For the Years Ended December 31, 2015, and 2014

EXHIBIT 3

Sample Not-For-Profit Statement of Position For the Years Ended December 31, 2015, and 2014

EXHIBIT 4

Sample Not-For-Profit Statement of Cash Flows For the Years Ended December 31, 2015, and 2014

Suppose the organization determines that the most useful information to provide in the cash flow from operating activities section would be cash provided by donations, interest, and dividends, along with cash used to pay program authorizations, salaries, health insurance, and operating expenses. If the organization has individual receivable and payable accounts for each of those lines, preparation of the operating activity section using the direct method becomes as easy as using the indirect method. Exhibit 5 shows a trial balance modified for these delineations. Exhibit 6 shows what the cash flows from operating activities would look like. Generating the amounts can be done using a simple spreadsheet; the amount from the statement of activities is adjusted by the change in the related receivable or payable.

EXHIBIT 5

Revised Trial Balance

EXHIBIT 6

Statement of Cash Flows Cash Flows from Operating Activities

A Path to More Descriptive Reporting

Preparing a cash flow statement using the direct method can be as easy as using the indirect method, if the lines that will be displayed are given some forethought and individual receivable and payable accounts are set up for each line in the preceding year. Without the individual receivable and payable accounts, the manual manipulation to arrive at the cash received or cash paid for each line disclosed can be overwhelming; with them, the process is trivial.

The main impediments to using the direct method have been the requirement to also disclose the indirect method and the inability to easily generate the information. The final ASU 2016-14 takes care of the first for NFP entities, and, as shown above, careful planning takes care of the second.

Source: https://www.cpajournal.com/2017/04/20/preparing-statement-cash-flows-using-direct-method/

Postar um comentário for "Easy Way to Do Direct Method Cash Flow Statement"